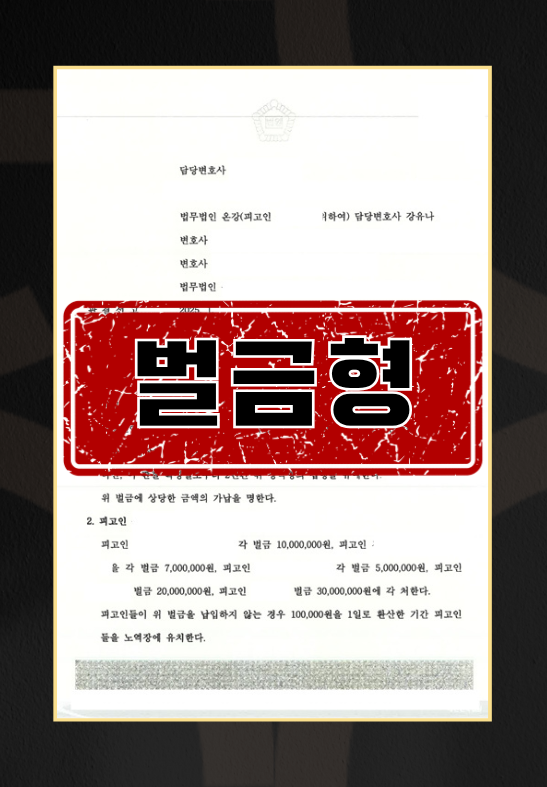

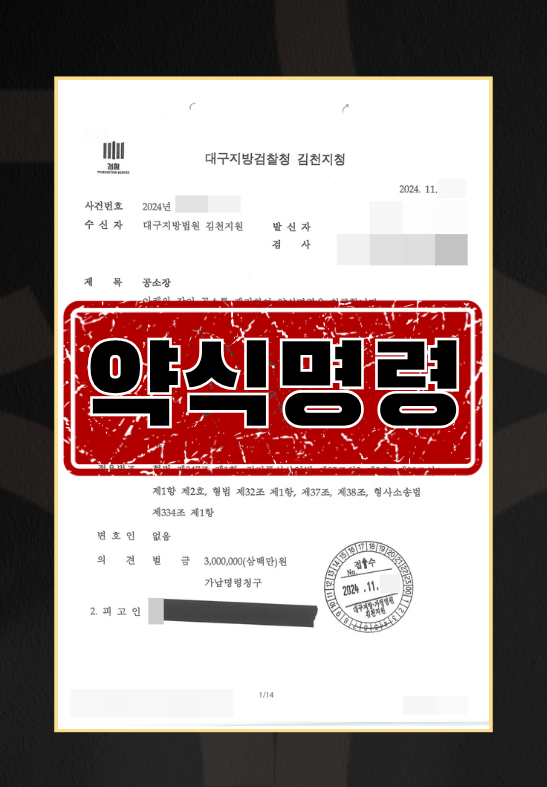

Fraud charges filed after borrowing money for business and failing to pay it back

■ Overview of the Case The client was running a business and encountered a shortage of funds in the process of business expansion. The client borrowed funds from an acquaintance, but lost the ability to repay due to business failure and became involved in a legal dispute. The client admitted that his mistake in judgment and management failure caused financial damage to the victim, and he was deeply remorseful and striving to recover the damage. Under these circumstances, the client sought out Ongang Law Firm to resolve the case. ■ Case Issues The key issue in the case was whether the client was guilty of fraud because he expressed his intention to repay the money even though he was unable to do so at the time he borrowed the money from the victim. Ongkang's assistance Ongkang's lawyers carefully analyzed the client's situation and formulated a strategy to resolve the case. First, the client's history of business failure and use of funds to prove that he had no malicious intent to deceive in his relationship with the victim.