Alleged violation of the Capital Markets and Financial Investment Business Act in connection with the operation of open chat rooms

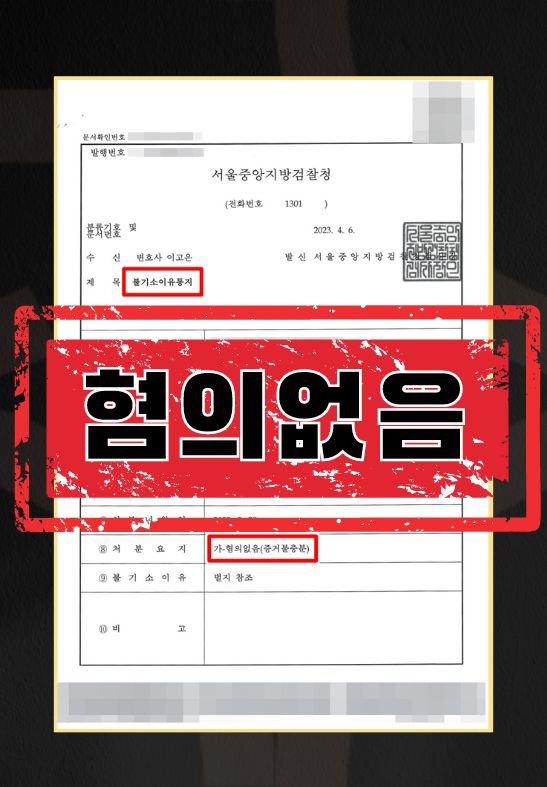

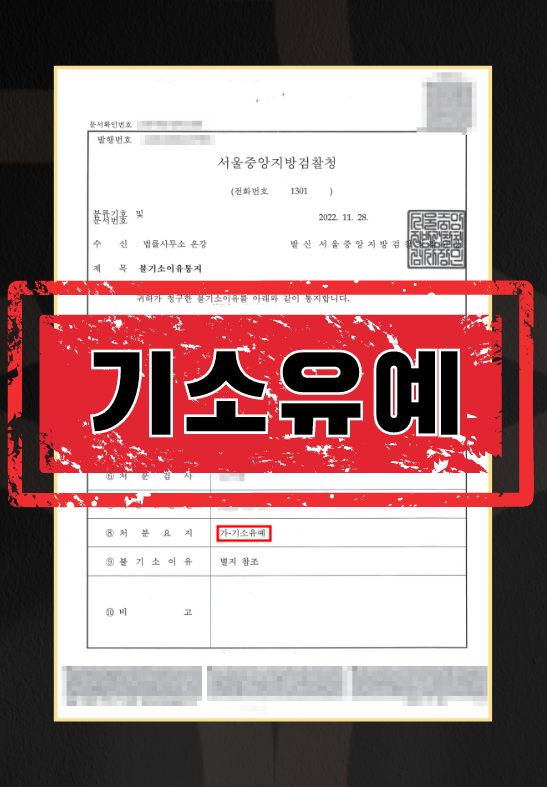

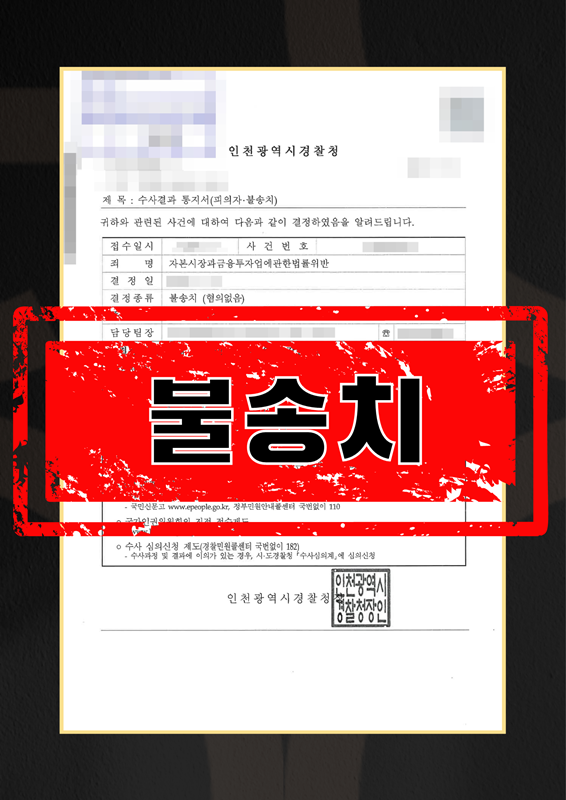

After leaving his job at an investment-related company, the client opened an open chat room to follow up with 10 clients he had managed. Later, he opened another open chat room with plans to start a business after filing a pseudo-investment advisory business registration. The client did not engage in any activities such as stock recommendations in the above two chat rooms, but there were accusations that the client provided investment advice without filing a pseudo-investment advisory business registration and received compensation, and the case was prosecuted for violating the Capital Market and Financial Investment Business Act. ■ Case Issues The client had recommended stock stocks to about 10 people, but it was a follow-up to the work he had done before leaving the company, and he had never recommended stock stocks in public open chat rooms. The issue was whether the client had provided investment advice to an unspecified number of people and whether he had received compensation from about 10 people. The defense team of Ongang Law Firm argued that the client's former company's business should not be considered as a business after the fact.