Case overview

In this case, the defendant was entrusted by a client to manage an account, including paying capital gains taxes, and misappropriated the entrusted funds.

The defendants withdrew tens of millions of won from the complainant's account in the name of paying capital gains taxes, but the actual amount of taxes paid was much less than that, and the defendants used the remaining amount for personal use. The client came to Ongang Law Firm.

Case issues

The key issues in this case were twofold: first, the scope and limits of the delegation of account management; and second, whether the defendants' conduct constituted embezzlement. In particular, the existence of an "implied authorization to use" and the actual use of the funds for capital gains taxes were critical issues.

Assistance from the warm river

Ongang Law Firm's defense team took a multifaceted approach to successfully resolve this case. First, we carefully analyzed the bank's account transaction records to obtain objective evidence to prove the defendants' illegal acts. In particular, we organized the account deposits and withdrawals in a time series before and after the payment of capital gains tax, which clearly revealed the circumstances of the defendants' misappropriation of funds.

We also consulted with tax experts to accurately calculate the actual capital gains tax liability, which provided concrete figures for the amount of the defendants' overdrafts. Furthermore, through the analysis of similar cases, we systematized the legal theory of what constitutes embezzlement and convincingly presented the prosecution of the defendants' crimes.

In particular, the firm organized and submitted evidence from the complaint stage, and communicated closely with the investigating authorities to ensure that the investigation was properly directed.

Results

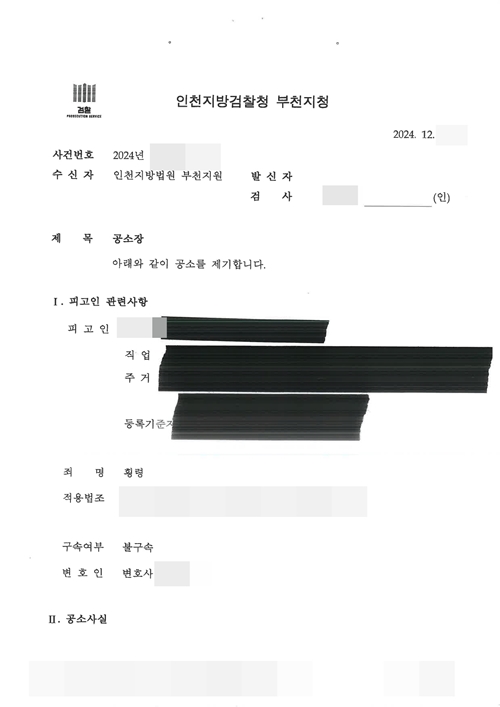

Our careful legal review, evidence gathering, and strategic response led to the prosecution's decision to charge the defendants, which ultimately resulted in a disposition of the caseagainst the defendants.

Case outcome materials