Case overview

The client was in the business of constructing and leasing multifamily housing, and signed lease agreements with tenants and received deposits. However, due to unexpected changes in the financial environment and refusal to extend loans, the client was declared bankrupt, which delayed the return of the tenants' deposits and led to the client being sued for fraud. The client came to our firm to complain about the injustice.

Issues in the case

1. whether deceptive practices existed at the time the lease was signed for the purpose of obtaining the security deposit

2. whether the tenants' security deposits were diverted to other purposes, such as the sale of an office building

3. determination of the suspect's ability to repay and sincerity of intent to return the security deposit

Assistance from the warm river

Ongang Law Firm carefully analyzed the client's business process and cash flow to build the following defense logic:

1. presented the real estate market value and loan status data at the time of the lease agreement to prove that the client had sufficient financial strength.

2. the deposit was used for legitimate purposes, such as building construction and loan repayment, as evidenced by account transactions.

3. prove that the refusal to extend the loan due to the deterioration of the financial environment was unforeseeable, such as through a recording of a conversation with a representative of the financial institution.

4. the client has obtained and submitted numerous documents showing that the client has made a good faith effort to return the tenants' security deposits.

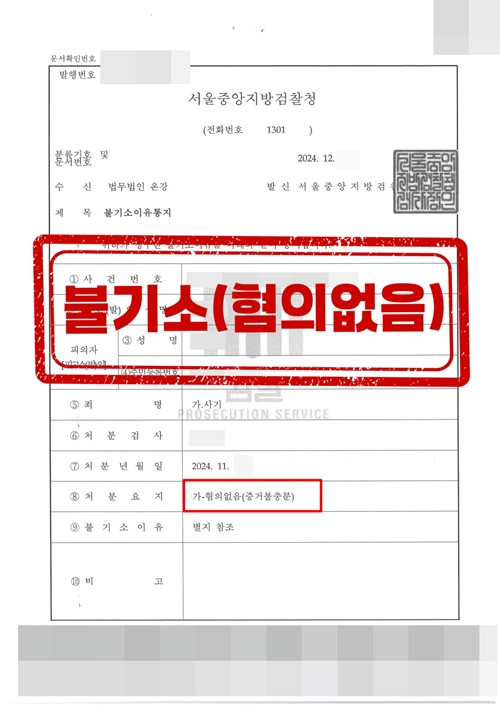

Results

The Seoul West District Prosecutor's Office determined that our client did not have the purpose of deceiving the tenants and extorting the security deposit through extensive evidence and legal review submitted by our firm. no charges due to insufficient evidence for insufficient evidence.

Case outcome materials